Code of practice for commercial property relationships following the COVID-19 pandemic

Published 9 November 2021

Applies to England, Northern Ireland and Wales

Ministerial foreword

Britain’s pubs, shops, cafes, restaurants, and small businesses have been, and remain, the beating heart of our economy.

Despite the profound changes to the way we live, shop and work over the last few years – changes magnified and accelerated by the COVID-19 pandemic – we know these businesses have a defining role to play in creating growth, building social capital and driving forward this government’s principal ambition to level up communities across the country.

It was therefore only right, in response to the immense challenges created by the Coronavirus pandemic, that we acted quickly and decisively to protect businesses on our high streets and beyond.

We introduced a moratorium on commercial landlords evicting tenants because they were unable to pay their rent. Restrictions were put in place to stop landlords unnecessarily seizing goods owned by the tenant in lieu of rent, and we stopped businesses in rent arrears from being made insolvent by their landlord.

The government also worked together closely with businesses leaders to publish a voluntary code of practice. This code provided clarity for both tenants and landlords, encouraging them to work together on resolving unpaid rent. From the outset of the code’s publication, we said that we would continue listening to voices from across the sector on how we could shield businesses from the worst economic shocks this virus has wrought.

That is why we held a call for evidence over the spring and engaged with tenants, landlords and businesses big and small throughout the year to hear their views. The evidence collected clearly shows that in a minority of cases, some landlords and tenants have been unable to resolve their disputes over rent arrears.

Our Commercial Rent (Coronavirus) Bill will help bring these cases to a swift resolution.

The Bill allows for the ringfencing of rent debt built up by businesses who have been forced to close during the pandemic. It establishes a binding arbitration system which will then decide what happens to that ringfenced debt. Moratorium measures will continue until the Bill has become law.

This updated commercial rents code of practice aligns with this legislation and sets out what this arbitration process will look like, the kind of evidence that will be considered, and the key principles of fairness, affordability, and viability that it will adhere to.

The code states, that where it is affordable, a tenant should aim to meet their obligations under their lease in full.

It makes clear that the preservation of the tenant business’ viability should not come at the expense of the landlord’s solvency.

However, it also explicitly states that tenants should never have to take on more debt – or restructure their business – in order to pay their rent.

The code provides guidance on how parties should approach negotiation, with the intention that where possible they should resolve rent disputes before the Bill comes into force.

Alongside the published Bill, this code can be used by any business to help them negotiate and resolve rent disputes even if they fall outside of scope for arbitration.

Together, the Commercial Rent (Coronavirus) Bill and our commercial rents code of practice set out a clear path for both landlords and tenants to move from dispute to resolution together. They will help businesses, irrespective of size or sector, to grow and plan for a brighter future after COVID, so that they can remain the beating heart of our economy for generations to come.

Minister Neil O’Brien, Parliamentary-Under Secretary for Levelling Up, the Union and Constitution

Introduction

1. This code applies to all commercial leases held by businesses which have built up rent arrears, due to an inability to pay, as a result of the impact of the COVID-19 pandemic, whether, for example, in the hospitality, retail (including supply chains), leisure, manufacturing, industrial and logistics, ports, food and drink, or rural sectors. Businesses within the agricultural sector may also want to consider the principles included, whilst acknowledging the differing legal framework for agricultural tenancies.

2. This code of practice is issued in response to the impact of COVID-19 on landlords and tenants in the commercial property sector and replaces the ‘Code of practice for commercial property relationships’ issued on 19 June 2020 and updated on 6 April 2021.

3. This code is therefore relevant for all commercial rent debts (including service charges and insurance) accrued since March 2020 within England, Wales, Northern Ireland, and Scotland, to assist with the terms of negotiation.

Background

4. COVID-19 and the associated closure measures have had a significant impact on the economy, particularly on the income of the hospitality, leisure and retail sectors and their supply chains. Whilst there is indication that, overall, rent collection is increasing, it remains below average levels especially in certain sectors.

5. In April 2021, the government launched a call for evidence (across England) which invited landlords, tenants, and other interested parties to outline their experiences negotiating settlements of rent debt. Additionally, the call for evidence sought views on a number of options for withdrawing or replacing the current tenant protection measures. The results and analysis of the call for evidence can be found here: Commercial rents and COVID-19: call for evidence.

6. In addition to this, government has continued to engage extensively with landlord and tenant groups, particularly small businesses, following the publication of the voluntary sector-led code in June 2020. We are grateful to the sector for this engagement and for their feedback on the new code, the Bill, and on the broader arbitration process.

7. The government’s policy aim is to preserve otherwise viable businesses and the millions of jobs that they support. In light of this and following analysis of responses to the call for evidence, government announced on 16 June that legislation will be introduced to support the resolution of commercial rent debt (including service charges and insurance) accrued during the pandemic. This legislation is detailed in the section of this code titled ‘Commercial Rent (Coronavirus) Bill.’

Purpose

8. As noted above; the government’s intention is that, where possible, rent debt accrued as a result of the COVID-19 pandemic should not force an otherwise viable business to cease operating. Contractual commitments should be recognised as far as possible while achieving a proportionate balance between the interests of landlords and tenants.

9. This code is therefore intended to assist landlords and tenants in resolving disputes relating to rent owed as a result of premises having been closed or having had business restricted during the COVID-19 pandemic. The code of practice seeks to do this by:

a. explaining the scope and contents of the upcoming ‘Commercial Rent (Coronavirus) Bill’ including its creation of a binding arbitration process

b. providing best practice for landlords and tenants who are not in scope of the arbitration process

c. promoting good practice within landlord and tenant relationships, particularly regarding the negotiation process (set out within the corresponding section)

d. providing the principles that should guide the landlord and tenant in consideration or negotiation of the debts referred to above

10. Further guidance to assist arbitrators, alongside more specific guidance for landlords and tenants on the details set out in the Commercial Rent (Coronavirus) Bill, will be published once the Bill has passed through parliament. The guidance published will be consistent with the principles set out in this code of practice. The intent is that the arbitration process, including the paperwork required, will be simple and streamlined, enabling cases to conclude rapidly and landlords and tenants to return to business as usual.

11. Whilst not intended as a guide, arbitrators should note that the scope, principles, viability, affordability, and binding arbitration elements of this code provide information which may be of interest until such time as detailed and targeted guidance is published.

Government objectives

12. It is in the interests of both landlords and tenants to do everything reasonable to enable otherwise viable (see Viability section) businesses to continue operating through this period of recovery. As such, we encourage landlords and tenants to negotiate regardless of whether accrued rental debts fall within scope of the Bill.

13. The legal position remains that tenants are liable for covenants and payment obligations contracted under the lease, unless this is renegotiated by agreement with landlords, or some relief is given as a result of the arbitration process explained within the upcoming section titled ‘Binding arbitration process.’

14. Our expectation therefore remains that tenants who are able to pay their rent debt in full should do so. However, we recognise the extreme impact closures had on certain businesses, and we therefore encourage landlords and tenants to work together. Tenants who are unable to pay in full should, in the first instance, negotiate with their landlord in the expectation that the landlord will share the burden where they are able to do so and as set out within this code. This will allow landlords to support those tenants who are in need and might otherwise be unable to continue trading.

15. We recognise that there will be circumstances where parties are unable to reach agreement by themselves. Further information on resolution of these circumstances is contained within the ‘Negotiation’ section below.

Existing agreements

16. Some landlords and tenants will have already come to agreements in response to COVID-19 and have followed best practice in doing so. Any existing agreements should continue to be honoured, and neither the publication of this code, nor the Commercial Rent (Coronavirus) Bill change that.

17. We encourage tenants to be clear with landlords about the periods any rent payments made by them relate to. Rent paid outside of the ringfenced period (see Annex A) will be treated as covering such period of debt as the tenant has specified (or alternatively, landlord and tenant have agreed, and they are encouraged to reach agreement in that respect). In the absence of specification (or agreement) by the tenant of the period the sum relates to, it will be treated as being payment for rent due outside the period within scope of the arbitration process (explained within the ‘Binding arbitration process’ section of this code).

The Commercial Rent (Coronavirus) Bill

18. Further to the announcement of 16 June 2021, the Commercial Rent (Coronavirus) Bill aims to support the resolution of commercial rent debt accrued during the pandemic. Once the Bill becomes law, it will introduce a system of binding arbitration (explained in the ‘Binding arbitration process’ section). Whilst the binding arbitration system is designed to meet government’s aims as expressed at the beginning of this code, as with any Bill, it is subject to passage through Parliament and the details of the Bill given below may be subject to alteration or change. We will update this code to reflect any agreed changes.

19. The above legislation will apply to England and Wales, and Northern Ireland will have a power to make similar legislation. It will not apply substantively to Scotland[footnote 1] but use of the Code as set out in the Negotiation, Behaviours, Principles, Affordability and Viability sections will still be expected to be adhered to where appropriate.

20. The binding arbitration process will provide a legal avenue for the minority of landlords and tenants, whose businesses are in scope (see Scope section below) and who have been unable to reach agreement, to have their case considered in a proportionate way. Any consideration will be consistent with the principles set out in the Commercial Rent (Coronavirus) Bill, as detailed by this code and consistent with the aims set out within the preceding sections. Further information on the proposed process is given in the section titled ‘Binding arbitration process’.

Modifications to remedies for unpaid rent in the Bill

21. The Bill will temporarily prevent certain remedies and measures from being exercised in relation to the ring-fenced debt. All remedies which are restricted will only be restricted in relation to the ringfenced rent debt. The period for which these remedies will be restricted will (unless otherwise stated below) be from the legislation coming into force until (a) a settlement has been reached (either through negotiation or through the arbitration system, when the time to appeal an arbitration decision has passed), or (b) the timeframe for application to the arbitration system has passed without an application being made.

22. The Bill will ensure that for tenancies within the scope of this process, landlords remain temporarily prevented from using legal avenues that are currently unavailable under the moratorium on forfeiture contained within the Coronavirus Act 2020, prohibition on winding-up petitions in Schedule 10 to the Corporate Governance and Insolvency Act 2020 and measures in relation to Commercial Rent Arrears Recovery (CRAR) made through amendments in The Taking Control of Goods (Amendment) (Coronavirus) Regulations 2021.

23. In addition, the Bill will prevent landlords from issuing debt proceedings (for County Court or High Court Judgments) whilst arbitration is available or ongoing, and enable the debt covered by certain debt proceedings to be considered in arbitration. More information on this can be found within the notice here.

24. Landlords will also be prevented from drawing down on tenancy deposits to cover outstanding ringfenced rental arrears. In the case that a landlord has already drawn down on the deposit and used it to cover ringfenced debt, the requirement for the tenant to top-up the deposit will be suspended.

25. On the apportionment of rent, tenants are expected to specify which period of rent is being paid for. If an unspecified amount is, or has been, paid by the tenant following the end of the ring-fenced period, the landlord must use it to cover rent outside the ringfenced period.

26. There are certain restructuring processes available to tenants: Company Voluntary Arrangements (CVA), statutory restructuring plans and schemes of arrangement. Tenants that have entered the arbitration system may not include the ringfenced rent debt in any CVA, restructuring plan or scheme of arrangement after an arbitrator is appointed and for a period of 12 months, beginning when the arbitration settlement is awarded.

27. Equivalent measures in respect of tenants which are individuals are covered, as well as entities such as companies.

Scope

28. The Commercial Rent (Coronavirus) Bill will apply in respect of unpaid rent arrears relating to the ring-fenced period, of business tenants which:

a. were mandated to close their premises or cease trading (in whole or in part, including with exceptions such as non-essential shops being allowed to open for collections) under regulations made under the Public Health (Control of Disease) Act 1984 during the COVID 19 pandemic; and

b. lease their premises under a business tenancy, as defined by Part II of the Landlord and Tenant Act 1954, that is a tenancy under which premises are occupied by the tenant for business purposes (or business and other purposes)

29. As mentioned at point 19, Northern Ireland will have a power to introduce similar legislation is respect of business tenancy defined under the Business Tenancies (Northern Ireland) Order 1996.

30. The ringfenced period is from 21 March 2020 to the last date restrictions (not guidance, and other than generally applicable rules such as displaying information about wearing face masks) were removed from the business tenant’s sector.

31. This means premises that were able to continue trading and were not forced to close, for example pharmacies, are not within scope of the legislation. A summary of the ringfenced periods and the businesses affected can be found in Annex A to this code. For example, for a clothing shop in England the ring-fenced period ran from 21 March 2020 to 12 April 2021 (when non-essential retail was allowed to re-open); and for a café in England the ring-fenced period ran from 21 March 2020 to 18 July 2021 (when restrictions ended on table booking size and requirement for customers to eat while seated).

32. As noted at points 12 and 13, we expect those out of scope to pay in full if they are able to (while maintaining the viability of their business). Where this is not possible, we expect tenants to negotiate with their landlords as set out below. We also recognise that there are many businesses, including for example, supply businesses that closed and others that may have found it uneconomical to open, that do not sit within the legislation but were impacted. Here we strongly support landlords and tenants coming together to use the principles and methods set out in this code to negotiate and come to an agreement on outstanding rent arrears that protect the viability of the business, thus benefitting the landlord and the wider economy.

33. Business tenancies which were in place for some or all of the ring-fenced period but have since ended, provided they meet the other criteria for inclusion, will be in scope. If a business tenancy is in a chain of tenancies, only the business tenancy (under which the tenant occupies the premises) is in scope. Tenancies where parties have already come to agreement on arrears will also be out of scope.

34. The ringfence will cover rent, service charges and insurance, where paid to the landlord or a representative. Payments to third parties will not be included.

35. Landlords and tied pub tenants in England and Wales may be within scope of the Bill and at the same time within scope of the Pubs Code: The Pubs Code etc. Regulations 2016. The Bill does not affect the provisions of the Pubs Code.

Existing forfeiture and recovery restrictions

36. To provide the time to introduce and pass legislation, the moratorium on forfeiture and restrictions on the use of CRAR regime remain in place until 25 March 2022, unless legislation is passed ahead of this. The moratoriums on forfeiture in Wales and Northern Ireland respectively are in place until 25 March 2022.

37. Following the replacement of the current protections with the new arbitration legislation and provided that such action is not in scope of the binding arbitration process, landlords will be able to exercise their ordinary enforcement rights in the ways they did prior to the moratorium. Action could be taken in respect of:

a. non-payment of rental arrears incurred prior to March 2020 and from the end of the ringfenced period onwards

b. tenants that fall outside the scope of arbitration legislation over the non-payment of rental arrears accrued at any time

c. charging interest on rent liabilities incurred from the end of the ringfenced period onwards, if such interest payments are included in the terms of the lease

38. In Scotland, anti-irritancy measures for non-payment of rent are in place until 30 March 2022, with two-monthly reviews from 30 September 2020. As previously, evictions in Scotland will still be permitted but 14 weeks’ notice is required rather than the previous 14 days.

Negotiation

39. As stated above, where a tenant is unable to pay in full, we encourage all landlords and tenants to attempt negotiation regardless of whether the debts owed are in scope of the Commercial Rent (Coronavirus) Bill. If agreement is reached, we recommend that parties confirm this between themselves, formally and in writing. Where parties reach a legally binding agreement, the arbitration process will not override this.

40. We recognise the difficulties that many landlords and tenants are facing, particularly those affected by the closures during lockdown. Not all tenants will be in the same position as they previously were in terms of ability to pay rent and it may be in the interest of both landlord and tenant to reach new arrangements for unpaid rent (if they have not already done so). We hope this code will help provide options for tenants and landlords to discuss, and that this will in particular help smaller businesses without access to significant legal or other resources.

41. Tenants experiencing temporary severe hardship because of the impact of COVID-19 should feel able to approach their landlords to discuss and negotiate rent owing or other support available to them. Landlords should consider a reasonable case put forward by a tenant in such distress and whether some temporary arrangement the landlord can reasonably offer might enable the tenant to survive.

42. Tenants will need to show landlords sufficient evidence to substantiate their need for assistance with rent. The types of evidence that should help to substantiate the need for assistance are outlined in Annex B. Landlords may wish to make clear the impact of late or non-payment of rent on their own circumstances. Where the tenancy forms one of many such tenancies for landlord or tenant then this may be relevant to the discussions.

43. Each relationship will need to respond to these circumstances differently. We encourage landlords and tenants to consider the behaviours, principles, affordability, and viability statements below when negotiating.

44. The relationship between landlord and tenant is defined by law and parties may wish to seek legal advice when agreeing payment arrangements.

45. We recognise there will be cases where landlords and tenants negotiate following the advice set out within this code, but are, or have been, unable to reach a specific agreement. They might both feel that a negotiated outcome could still be achieved, and therefore they should consider alternative means of resolving their dispute, such as a third-party mediator who could be employed by mutual agreement of tenants and landlords to help facilitate negotiations (if the cost of this is proportionate and with the understanding both sides would bear their own costs).

46. Where either party chooses not to use alternative dispute resolution, or the process used failed to resolve the dispute, the parties would not be prevented from applying for statutory arbitration (even if the alternative process was mandatory under the lease). For further information on alternative dispute resolution, see GOV.UK - alternative dispute resolution.

47. Where landlord and tenant are unable to reach agreement by negotiation, they may be able to apply for binding arbitration (further details on eligibility are given within the section titled ‘Commercial Rents (Coronavirus) Bill’).

48. Parties undertaking the binding arbitration process will be required to make offers to each other as part of both the pre-application and arbitration process. However, this does not preclude parties from reaching an agreement by negotiation prior to or outside of this process. We encourage landlords and their tenants to continue to negotiate, even once the arbitration process has commenced and even if negotiations appeared to have stalled or failed prior to arbitration.

Behaviours to be exhibited by landlord & tenant

49. When negotiating rent arrears, or undertaking binding arbitration (as detailed in the corresponding section of the code) the landlord and tenant should attempt to exhibit the following behaviours:

a. transparency and collaboration: we (landlord and tenant) have a mutual interest in business continuity that reaches far beyond the extent of this pandemic. We are economic partners, not opponents. Therefore, in all dealings with each other, in relation to this code and the COVID-19 pandemic, we will act reasonably, transparently and in good faith. This should not affect any requirements for reasonableness and commercial confidentiality which exist in any regulatory regime or in relation to legislation

b. a unified approach: we will endeavour to help and support each other in all of our dealings with other stakeholders including governments, utility companies, banks, financial institutions, and others to achieve outcomes reflecting this code’s objectives, and to help manage the economic and social consequences of COVID-19

c. acting reasonably and responsibly: we will operate reasonably and responsibly, recognising the impact of COVID-19, in order to identify mutual solutions where they are most needed

d. a swift resolution: having regard to the above behaviours, and the future post-covid-19 economy, we will act to avoid costly or burdensome processes by ensuring we resolve disagreement as quickly as possible whilst acknowledging that such haste should not unintendedly undermine the rights held by either party

Principles

50. The following principles should be considered by landlord and tenant when considering rent owed as a result of premises having been closed, either due to restrictions or because it was not deemed viable to remain open, during the COVID-19 pandemic:

a. the aim is to preserve viable businesses

b. the preservation of the viability of the business of the tenant should not be at the expense of the solvency of the landlord

c. where it is affordable for a tenant to meet their obligations under the lease in full, they should do so without delay; any relief should be no greater than necessary for the tenant business to afford the payment

51. The circumstances which determine affordability for tenant and landlord should be considered.

52. If tenant and landlord are transparent as to their circumstances and provide documentation as necessary to affordability, that will allow each other and the arbitrator to make informed decisions.

53. The arbitrator will also adhere to these principles should binding arbitration be undertaken.

Viability and affordability

54. Where a viable tenant cannot afford to pay in full, the arbitrator (see the binding arbitration system outlined from paragraph 66) will consider issues of affordability, taking into account what the tenant can afford to pay whilst ensuring that the landlord’s solvency is preserved. We recommend that both landlord and tenant should also consider these points when negotiating.

Viability

55. We recognise that viable business models will differ from party to party and within differing sectors, we therefore do not propose to offer a set definition of viability, for example in stating a one size fits all requirement for set profit margins; rather we recommend that both landlord and tenant should consider the points below when negotiating.

56. Both parties should look at the viability of themselves or their businesses. They should also consider any resources that may be available to them and, having regard to their duties and other stakeholders, be willing to consider renegotiating rent where possible to ensure the continuation of viable businesses. We do not consider a fair outcome to require substantial borrowing or restructuring by either party.

57. When referring to viability, parties should consider whether ring-fenced debt aside the business has, or will in the foreseeable future have, the means and ability to meet its obligations and to continue trading.

Affordability

58. Where a viable tenant is seeking to deviate from the terms of the lease in respect of rent owed, they will need to demonstrate why the payment is unaffordable and what payment or payment period might otherwise be affordable in the near future. That may include information about their assets and liabilities, impact of COVID-19 on their business, and other information about their financial position and expenditure. A landlord can also evidence what is affordable to them, for example that a proposed reduction in rent demonstrates a threat to their solvency.

59. When referring to a landlord’s solvency a landlord should be considered solvent unless they are currently or are likely to become, unable to pay their debts as they fall due.

60. Where a tenant will not be viable without relief, but the relief requested would push the landlord into insolvency. The landlord should, where possible, consider a proportionate amount of relief that maintains their solvency as well as the viability of the tenant. The landlord’s solvency should be maintained.

61. We would expect that the landlord and tenant consider affordability in the context of debts owed being able to be paid as soon as practicable but over a period of no more than two years (24 months), to allow a return to normality as fast as possible.

62. For the purpose of the binding arbitration process, where the arbitrator is satisfied that a tenant has taken unjustifiable steps to alter its financial position so that its ability to afford to pay protected rent debt is reduced, for example through the payment of excessive dividends (not discounting that dividends may have been some tenants’ only income) the arbitrator will have the option to disregard the amounts involved in assessing any award. The arbitrator can also disregard anything that has been done by a landlord to manipulate their financial affairs so as to improve their position in relation to an award.

63. A non-exhaustive list of the documents landlords and tenants can use in to order to prove their financial situation within negotiation or arbitration can be found at Annex B to this code. We encourage landlords and tenants not to ask for more documentation than is otherwise needed to prove affordability.

Consideration of viability and affordability

64. The points below set out how viability and affordability should be considered during negotiation:

a. any settlement of rent debt should aim to preserve – in so far as possible – the tenant business and the jobs that it supports, without undermining the solvency of the landlord

b. for a tenant business to be eligible for rent concessions, it must be viable. If a tenant business has not been able to pay any rent since restrictions were lifted this may be evidence that the tenant business is not viable

c. where a tenant can prove that they cannot afford to pay all their rent debt, and can prove that their business is otherwise viable, the tenant should be entitled to rent concessions which consider both the tenant and landlord position

d. in cases where the tenant cannot afford to pay in full, concessions must be affordable both for the tenant and the landlord. At this stage, the impact on the landlord should be considered

e. when considering both tenant viability and what a tenant can afford to pay, evidence to be considered could include the existing and anticipated credit/debit balance, business performance since March 2020, assets, government assistance received (including loans and grants), and dividend payments to shareholders. This is not exhaustive.

f. where multiple debts are owed by one tenant to the same landlord, the tenant (and landlord, should they wish) should provide evidence on affordability relating to all debts. Where the tenant or landlord is part of a bigger group then evidence of affordability may include that wider context

g. when considering what is affordable for either a landlord or tenant, we would not expect this to include restructuring, borrowing, or the taking on of further debts

h. Service charge is paid by the occupier to cover the costs of maintenance and other services for the property. Regard should be had to whether payments reflect a cost that the landlord has paid, without receiving a service charge payment from the tenant.

65. We expect lenders to continue to demonstrate forbearance to their borrowers during the period in which arbitration is in effect. This is to allow landlords and tenants to negotiate constructively, and to avoid adversely impacting the decision of an arbitrator.

Binding arbitration process

66. As previously mentioned, the Commercial Rents (Coronavirus) Bill will introduce a binding arbitration process for businesses in scope and who have been unable to reach agreement to have their case considered in a proportionate way. Any consideration will be consistent with the principles and viability and affordability considerations set out in the preceding sections and recommended for negotiations.

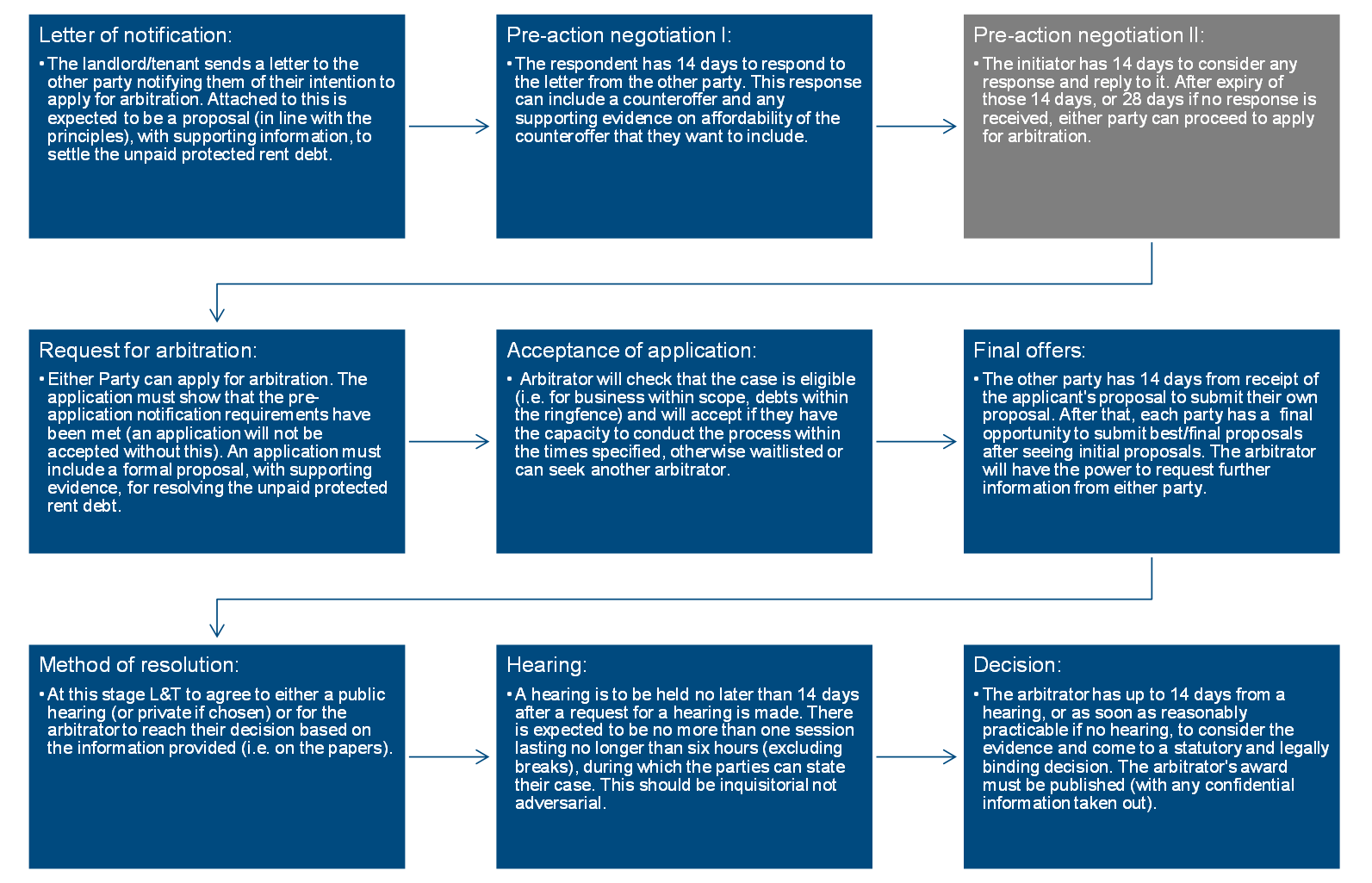

67. The binding arbitration process will have the following stages, with a visual representation of the process given at Annex C:

a. a compulsory pre-application stage:

i. a letter of notification: the landlord or tenant must notify the other party of their intention to pursue binding arbitration. At this point the party will be expected to submit a proposal for settlement of rent arrears accrued during the relevant period, supported by any appropriate evidence of affordability. The proposal and documentation should be in line with the behaviours, principles, documentation, and affordability criteria set out within the corresponding sections of this code

ii. the other party may respond and can either accept the proposal made or submit a counterproposal. As with the notification any counterproposal should be consistent with the information set out within this code. If the respondent is a landlord, they will not have to supply evidence of their financial position but should note that this may be considered at arbitration. The initiator will then have a period of time to respond, which could include submitting a new proposal if they choose to

b. an application by either the landlord or the tenant together with a fee: the application must include the notification sent during the pre-application stage, their proposal for resolution and relevant supporting evidence, including on viability and affordability in the case of a tenant

c. the other party will then have 14 days to submit their own proposal, together with any supporting evidence. Following that, the parties will have the opportunity to submit revised proposals for what the arbitrator’s award should be. All proposals should be based on the legislative principles. The arbitrator will have the power to request further evidence from either party

d. both the landlord and tenant will then be given the choice of a public hearing or, if neither party asks for a hearing, the arbitrator will consider the matter based on the documentation provided

e. the arbitrator will seek to conduct a hearing no more than 14 days from the receipt of a request for one. The arbitrator will decide how to conduct the hearing, which should not last more than six hours (excluding breaks)

f. the arbitrator will consider their decision based on the written evidence and any hearing and notify parties, within 14 days of a hearing, of the award made. The arbitrator’s award will be legally binding.

68. When deciding what award to make, the arbitrator will assess the proposals submitted by the parties for resolution of the protected rent debt against the principles. The award will adopt whichever proposal is consistent with the principles, or if both are consistent the proposal which is most consistent. Otherwise, the arbitrator will make the award they consider is appropriate.

69. We aim to have the Bill passed by 25 March 2022, subject to Parliamentary approval, at which point the 6-month application window will open for parties to apply. The 6-month timeline is inclusive of the pre-application stage noted above.

70. Where a tenant has multiple premises with the same landlord or vice versa, these may be considered jointly providing that the parties agree, or if the arbitrator has decided to consolidate proceedings.

71. Whilst binding arbitration will only be available to those businesses who fall within scope of the legislation as outlined above, we would encourage all businesses to use these considerations as a basis when coming to their own negotiated settlements outside of arbitration. Should a business apply to have their cases considered under the arbitration process, the decision of the arbitrator will be legally binding. There will be grounds for appeal in limited cases: for example, on the basis that the tenancy wasn’t in scope.

Fees

72. The fees payable for arbitration will be set by the approved arbitration bodies and payable in advance. The Secretary of State will have power to set limits of fees, which would aim to be consistent with the market whilst not preventing access from small businesses.

73. Any such limits are expected to be variable; with a sliding scale, relative to the size of the rental arrears owed, used to determine the cap and ensure it is proportionate for each case.

How arbitrators will be chosen

74. Arbitration bodies will have to demonstrate that they are competent to supply arbitration dispute resolution services. This competency will be assessed by BEIS against an ‘Acceptance Model’ that will set out the criterion that will have to be met. The criterion will consist of standards such as evidencing impartiality, monitoring and training for their arbitrators, a robust appeals system if complaints are made against any of their arbitrators and to meet our requirements for arbitrators to be well versed in business finances and commercial negotiations.

75. Arbitration bodies will publish a list of arbitrators that are approved according to these standards in due course, and landlords and tenants within scope will be able to apply directly to any approved arbitration body for arbitration, if negotiations have failed.

Annex A: Timelines

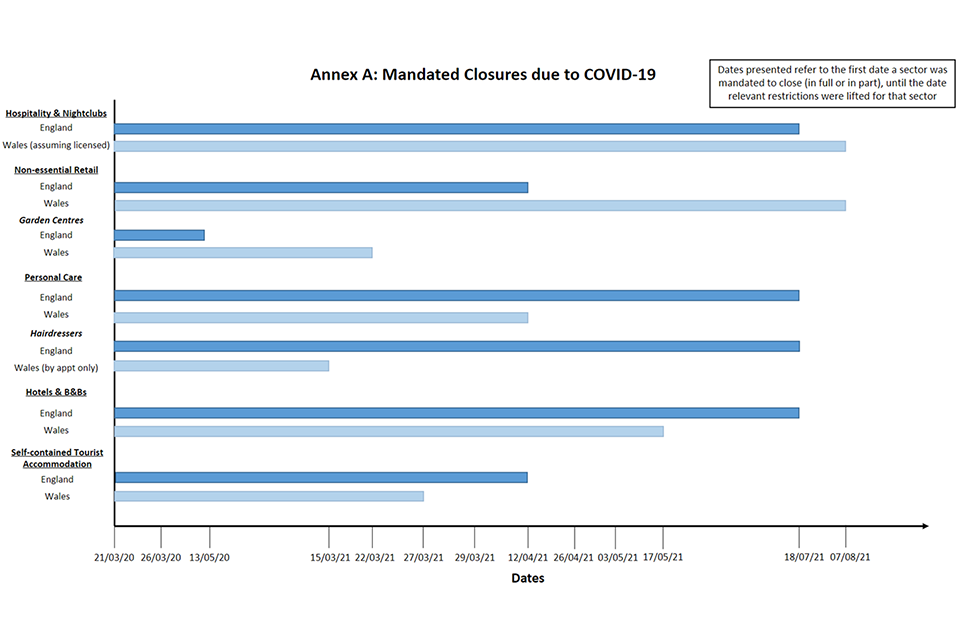

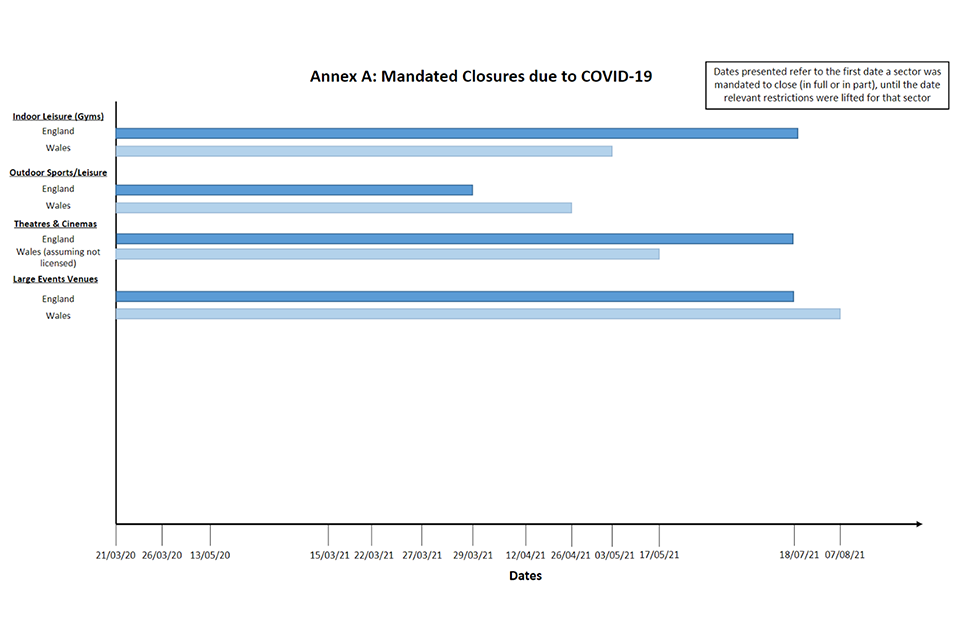

The ringfenced period in the Commercial Rent (Coronavirus) Bill is the period from 21 March 2020, when the first requirements on businesses to close their premises or cease trading (in whole or in part, including with exceptions such as non-essential shops being allowed to open for collections) came into force under regulations made under the Public Health (Control of Disease) Act 1984 to the date when specific restrictions (other than generally applicable restrictions such as displaying information about wearing face coverings) were last removed for the relevant sector.

The below graph represents the ringfenced period for differing sectors.

Please be aware that the graph is only a representation. The ringfenced period should be considered on a business-by-business basis and tenants may not fit neatly into the sectors used for representation purposes in this annex.

Northern Ireland has not been included in the below representation as Northern Ireland will have a power to make similar legislation and as such the ringfenced period for Northern Ireland will be addressed in separate legislation.

The below table sets out the dates in which mandatory closures (in full or in part) were enforced by government alongside the sectors to which each closure applied. The dates shown in bold are those used to represent the end of a ring-fenced period in the graph above.

This table may help landlord and tenant to understand the periods a business was mandated to close or permitted to trade within the ringfenced period. This table is not relevant for the scope of the Bill; rather, it will help landlords and tenants understand periods during which businesses were mandated to open and close, to provide a better understanding of when tenants could be trading.

For the purpose of the Bill the ringfenced period (relevant to each sector) remains as per the graph above. Affordability will differ for each business and landlord and tenant should consider affordability in the manner set out by the code of practice.

To limit complexity; for localised restrictions such as tiered restrictions the locations are given alongside a definition of each tier rather than the specific sectors affected.

| Date | Announcement/Action | Region | Business affected |

|---|---|---|---|

| 21/03/20 | Forced closure of businesses with imposition of lockdown measures | England, Wales | Hospitality (pubs, bars, restaurants, cafes); nightclubs; all non-essential retailers; holiday accommodation, inc. Hotels and B&Bs (except room service); personal care; theatres; cinemas; gyms; leisure centres and outdoor sports facilities closed Note: All premises selling food or drink for consumption on the premises mandated to close. Retailers permitted to remain open: food, supermarkets, hardware, homeware, convenience stores, off-licences, banks, post offices, laundrettes/dry cleaners, pharmacies, vets, pet shops, petrol stations, bicycle shops, taxi/vehicle hire, funeral directors, storage, building and agricultural suppliers, car parks |

| 26/03/20 | Full lockdown | Northern Ireland | Cafes, bars, public houses, cinemas, theatres, bingo halls, concert halls, museums and galleries, casinos, betting shops, spas, nail and beauty parlours, spas, hair salons and barbers, massage parlours, tattoo and piercing parlours, skating rinks, gyms, swimming pools, bowling alleys, amusement arcades, soft play areas, leisure centres |

| 11/05/20 | Lockdown extended with minor amendments to restrictions | Wales | Garden centres reopen |

| 13/05/20 | Limited relaxation of lockdown restrictions | England | Garden centres reopen Note: Classified as essential retail |

| 05/06/20 | Easing of restrictions; certain businesses reopen | Northern Ireland | Animal care services, car showrooms, non-essential retail |

| 11/06/20 | Further easing of restrictions; certain businesses reopen | Northern Ireland | Non-essential retail, outdoor markets, repair shops |

| 15/06/20 | National lockdown restrictions further relaxed | England | All non-essential retail permitted to reopen |

| 22/06/20 | Reopening close-contact businesses | Wales | All non-essential retail reopens |

| 02/07/20 | Reopening close-contact and some other businesses | Northern Ireland | Nail, Beauty, Hair Salons and Barbers, Museums and galleries, betting shops |

| 02/07/20 | Restricted opening for café, restaurants, pubs, and bars | Northern Ireland | Cafés, restaurants, and bars |

| 04/07/20 | Restrictions imposed on areas in and around Leicestershire | England | Full lockdown |

| 04/07/20 | National lockdown restrictions further relaxed | England | Hospitality (pubs, bars, restaurants, cafes); theme parks; cinemas; museums; personal care, some hairdressers reopen Note: Gyms and leisure centres; live music venues; beauty salons and nightclubs remain closed |

| 05/07/20 | Further businesses permitted to reopen | Northern Ireland | Tattoo parlours, spas (providing services with water and steam), massage parlours |

| 09/07/20 | Further businesses permitted to reopen | Northern Ireland | Cinemas, bingo halls, gyms, amusements arcades, playgrounds |

| 11/07/20 | Self-contained holiday accommodation bookings accepted | Wales | Self-contained holiday accommodation reopens |

| 13/07/20 | Phased reopening for hospitality and tourism | Wales | Bars, restaurants and cafes with outdoor spaces; hairdressers; indoor visitor attractions reopen |

| 23/07/20 | Businesses closed or restricted | Northern Ireland | Bars, public houses and clubs, theatres, nightclubs, conference halls including hotels, concert halls, soft play areas |

| 25/07/20 | Further relaxing of restrictions | Wales | Other tourist accommodation reopens (hotels) |

| 27/07/20 | Further relaxing of restrictions | Wales | Beauty salons (personal care); cinemas; museums reopen |

| 03/08/20 | Further relaxing of restrictions | Wales | Indoor hospitality; bowling alleys; bingo halls reopen |

| 10/08/20 | Further relaxing of restrictions | Wales | Leisure centres; gyms; swimming pools; indoor play areas reopen |

| 14/08/20 | Indoor theatres, bowling alleys, soft play areas, etc. reopen | England | Theatres; bowling alleys; soft plays reopen |

| 13/09/20 | Certain businesses reopen | Northern Ireland | Soft play areas |

| 22/09/20 | Local coronavirus restrictions | Wales | Licensed businesses in Blaenau Gwent, Bridgend, Merthyr Tydfil and Newport must close at 11pm Note: Hospitality affected |

| 24/09/20 | Restrictions on hospitality and licensed premises | England and Wales | Hospitality to close at 10pm, table service only |

| 28/09/20 | Further local restrictions | Wales | Neath Port Talbot, Torfaen, Vale of Glamorgan – no mixing indoors, stay in local area |

| 01/10/20 | Further local restrictions | Wales | Denbighshire, Flintshire, Conwy, Wrexham – no mixing indoors, stay in local area |

| 05/10/20 | Restrictions in Derry and Strabane District Council Areas | Northern Ireland | Hospitality businesses, guest houses and hotels (food and drink restricted to guests), indoor facilities, cinemas, museums, galleries, trampoline parks etc., libraries (restricted opening) |

| 09/10/20 | Local restrictions in Bangor | Wales | Bangor |

| 14/10/20 | Three-tier lockdown system introduced | England | Tier 3 – Liverpool, Greater Manchester Tier 2 – Cheshire, Derbyshire, Lancashire, West & South Yorkshire, Durham, Northumberland, Tyne & Wear, Tees Valley, West Midlands, Leicestershire, Nottinghamshire Tier 1 – Rest of England Note: Tier 1 - medium alert (rule of six and 10pm-5am curfew for hospitality sector) Tier 2 - high alert (no socialising outside household or bubble indoors; rule of six outside; 10pm-5am curfew for hospitality sector) Tier 3 - very high alert (no indoor socialising; rule of six; pubs can stay open if offering meals; no overnight stays elsewhere; no travel outside your area) |

| 16/10/20 | Requirement to close premises and cease trading | Northern Ireland | Hospitality businesses (takeaway/delivery permitted), guest houses and hotels, cinemas, museums, galleries, skating rinks etc., libraries (restricted opening), close contacts services, driving instructions |

| 23/10/20 | 17-day ‘circuit break’ lockdown announced | Wales | Full lockdown – hospitality; nightclubs; all non-essential retail; holiday accommodation; personal care; cinemas; gyms; leisure centres closed |

| 05/11/20 | Forced closure of businesses with imposition of lockdown measures | England | Hospitality (pubs, bars, restaurants, cafes); nightclubs; all non-essential retailers; holiday accommodation, inc. hotels and B&Bs (except room service); personal care; theatres; cinemas; gyms; leisure centres and outdoor sports facilities closed |

| 09/11/20 | End of ‘circuit break’ lockdown | Wales | All restricted businesses permitted to reopen |

| 20/11/20 | Reopening of certain businesses | Northern Ireland | Close contacts and driving instruction by appointment |

| 26/11/20 | Restrictions on certain businesses | Northern Ireland | Close contacts, non-essential retail, leisure venues |

| 02/12/20 | End of month-long ‘firebreak’ lockdown | England | |

| 04/12/20 | Targeted restrictions in hospitality and leisure | Wales | Hospitality to close by 6pm, open for takeaway after 6pm, no alcohol sales. Indoor entertainment and visitor attractions to close |

| 11/12/20 | Removed restrictions on certain businesses | Northern Ireland | Non-essential retail |

| 11/12/20 | New requirements for certain businesses | Northern Ireland | Hospitality (track and trace recording), Unlicensed premises (seating requirements) |

| 14/12/20 | Outdoor attractions to close | Wales | All outdoor attractions, eg funfairs theme parks, to close |

| 19/12/20 | Bristol, North Somerset and South Gloucestershire move from Tier 3 to Tier 2 | England | Parts of Somerset and Gloucestershire |

| 20/12/20 | Tier 4 comes into force | England | London and South East Note: Stay at Home alert level – mixing rules tightened. |

| 20/12/20 | Alert level 4 comes into force | Wales | All non-essential retail, ‘close contact services’, leisure, hospitality, and fitness (and more) to close |

| 26/12/20 | More areas enter Tier 4 | England | Sussex, Oxfordshire, Suffolk, Norfolk, Cambridgeshire, all parts of Essex not already in tier four, Waverley (Surrey), and Hampshire - including Portsmouth and Southampton but excluding the New Forest |

| 26/12/20 | Premises close | Northern Ireland | Restaurants, cafes, bars, public houses, cinemas, theatres, concert halls, bingo halls, museums and galleries, casinos, betting shops, spas, nail bars, beauty parlours, hair salons, barbers, massage parlours, tattoo parlours, skating rinks, gyms, swimming pools, bowling alleys, soft play areas, amusement arcades, funfairs, playgrounds, sports grounds, outdoor markets, car showrooms, auction houses |

| 06/01/2021 | England enters third national lockdown | England | England Note: London and South-East |

| 06/02/21 | Closure of non-essential businesses (excepting deliveries) | Northern Ireland | Non-essential retail |

| 08/03/21 | Reopen for Click & Collect only | Northern Ireland | Non -essential businesses selling baby equipment, clothing, footwear & electrical goods |

| 15/03/21 | Hairdressers reopen by appointment only in Wales | Wales | Hairdressers reopen |

| 22/03/21 | Garden centres reopen in Wales | Wales | Garden centres reopen |

| 27/03/21 | Self-contained tourist accommodation reopens | Wales | Self-contained tourist accommodation (B&Bs, holiday cottages) reopens |

| 29/03/21 | Step 1 of Prime Minister’s Roadmap out of lockdown comes into force - outdoor sports permitted | England | Outdoor sports facilities reopen Note: Stay at Home order ends. People advised to stay local; gatherings in gardens permitted |

| 01/04/21 | Reopen for Click & Collect only | Northern Ireland | Garden centres and plant nurseries |

| 09/04/21 | Premises close | Northern Ireland | Nightclubs, conference halls including hotels, theatres and concert halls, outdoor visitor attractions, bingo halls, museums, galleries, cinemas, campsites and caravan parks, indoor swimming pools, indoor sports and exercise facilities, outdoor sports facilities, car washes, businesses serving alcohol, bed and breakfast establishments |

| 12/04/21 | Relaxation of restrictions | Wales | Non-essential retailers and personal care reopen |

| 12/04/21 | Reopen for Click & Collect | Northern Ireland | Non-essential retail |

| 12/04/21 | Certain businesses reopen | Northern Ireland | Vehicle showrooms, garden centres and plant nurseries, car washes |

| 12/04/21 | Step 2 of Prime Minister’s Roadmap comes into force | England | Non-essential retailers; personal care, including hairdressers; public buildings; leisure, including indoor gyms; theme parks and zoos reopen |

| 23/04/21 | Further businesses reopen | Northern Ireland | Close contact services including hairdressing and driving instruction, outdoor activity centres |

| 26/04/21 | Review of coronavirus regulations | Wales | Outdoor leisure, including swimming pools and attractions; outdoor hospitality venues reopen |

| 30/04/21 | Further businesses reopen (outdoor businesses generally reopen with restrictions) | Northern Ireland | Non-essential retail, gyms, swimming pools & other sports venues (with restrictions); licensed and non-licensed premises |

| 03/05/21 | Wales moves to alert level 3 | Wales | Indoor gyms and leisure centres reopen Opened with restrictions in place |

| 17/05/21 | Wales moves to alert level 2 | Wales | Indoor hospitality and indoor entertainment venues reopen; all tourist accommodation (including hotels) reopened Opened with restrictions in place |

| 17/05/21 | Step 3 of Prime Minister’s Roadmap comes into force | England | Indoor hospitality; hotels and B&Bs; larger seated events venues (with restrictions on numbers) reopen Up to 30 people outdoors Up to six people or two households indoors Max 10,000 people at venues |

| 24/05/21 | Businesses reopen indoors with restrictions | Northern Ireland | Licensed and non-licensed premises; tourist accommodation (with restrictions); libraries (with mitigations) |

| 04/06/21 | Businesses restrictions removed: Order food away from table, order food at buffet and carvery | Northern Ireland | Hospitality venues that do not serve alcohol |

| 17/07/21 | Wales moves to alert level 1 | Wales | Indoor events venues (with restrictions on numbers) reopen Opened with restrictions in place |

| 18/07/21 (11:55PM) | Step 4 of Prime Minister’s Roadmap comes into force | England | All restrictions on businesses eased; large standing events venues and nightclubs reopen Requirement removed for certain businesses and venues to take bookings for certain groups sizes only, ensure distance between tables in hospitality settings. |

| 26/07/21 | Remove need for appointment to visit | Northern Ireland | Close contact services |

| 27/07/21 | Ticket-only reopening | Northern Ireland | Theatres and concert halls |

| 07/08/21 | Wales moves to alert level 0 | Wales | All restrictions on businesses eased; large standing events venues and nightclubs reopen |

| 16/08/21 | Businesses reopen with restrictions | Northern Ireland | Conference and exhibition halls |

| 16/08/21 | Remove limit of person numbers at table | Northern Ireland | Hospitality |

| 10/09/21 | Ticket-only entry removed | Northern Ireland | Theatres and concert halls |

| 10/09/21 | Ease restrictions on movement, (Outdoor Hospitality) remove the requirement to be seated to order | Northern Ireland | Hospitality |

| 30/09/21 | Remove social distancing requirements for a seated performance | Northern Ireland | Theatres, concert halls, cinemas |

| 11/10/21 | Remove maximum number who stay overnight at tourist accommodation | Northern Ireland | Tourist accommodation |

| 11/10/21 | Remove requirement to remain seated during a performance | Northern Ireland | Theatres, concert halls, cinemas |

Annex B: Evidence to consider when negotiating

When considering tenant viability and affordability, parties and the arbitrator may wish to take the following non-exhaustive list of factors into account:

- existing and anticipated credit/debit balance

- business performance since March 2020

- tenant’s assets (noting that some may be liquid assets such as cash and other may be plant and machinery which cannot be sold without ending the business)

- position of the tenant with other tenancies i.e., ability to absorb the costs within those other tenancies

- government assistance received by the tenant including loans and grants (which may not have covered rent but provided some financial support to the business)

- dividend and bonus payments to shareholders

- excessive or unreasonable dividend payments to directors (having regard for the fact that director dividends may be the director’s only income during the ringfenced period)

- overdue invoices or tax demands

- unpaid or returned cheques or electronic payments

- exceeding overdraft limits

- creditor demands

- money judgments

- expert evidence received as to the tenant’s current trading position, e.g., from the tenant’s accountant

- shortfalls in share issues

- evidence of prior refusal of further credit, funding, or lending, (although the possibility that the tenant could obtain finance if it has not already applied for it is not to be considered a factor)

- failure to meet budget projections

- loss of important contracts

- insolvency of a major customer

- unexpected retentions -knowledge of a lack of working capital, or

- loss of key personnel or staff redundancy.

These factors may also be used to assess the impact on the landlord’s solvency, should the landlord wish to provide evidence. We recognise that in some cases, there will be differing factors that parties or an arbitrator may wish to consider. This is a non-exhaustive list which has been designed to provide an indication of possible relevant information and which should be applied flexibly on a case-by-case basis.

Annex C: Arbitration process

Annex C: Arbitration process - plain text version

Letter of notification

- The landlord/tenant sends a letter to the other party notifying them of their intention to apply for arbitration. Attached to this is expected to be a proposal (in line with the principles), with supporting information, to settle the unpaid protected rent debt.

Pre-action negotiation I

- The respondent has 14 days to respond to the letter from the other party. This response can include a counteroffer and any supporting evidence on affordability of the counteroffer that they want to include.

Pre-action negotiation II

- The initiator has 14 days to consider any response and reply to it. After expiry of those 14 days, or 28 days if no response is received, either party can proceed to apply for arbitration.

Request for arbitration

- Either Party can apply for arbitration. The application must show that the pre-application notification requirements have been met (an application will not be accepted without this). An application must include a formal proposal, with supporting evidence, for resolving the unpaid protected rent debt.

Acceptance of application

- Arbitrator will check that the case is eligible (i.e. for business within scope, debts within the ringfence) and will accept if they have the capacity to conduct the process within the times specified, otherwise waitlisted or can seek another arbitrator.

Final offers

- The other party has 14 days from receipt of the applicant’s proposal to submit their own proposal. After that, each party has a final opportunity to submit best/final proposals after seeing initial proposals. The arbitrator will have the power to request further information from either party.

Method of resolution

- At this stage L&T to agree to either a public hearing (or private if chosen) or for the arbitrator to reach their decision based on the information provided (i.e. on the papers).

Hearing

- A hearing is to be held no later than 14 days after a request for a hearing is made. There is expected to be no more than one session lasting no longer than six hours (excluding breaks), during which the parties can state their case. This should be inquisitorial not adversarial.

Decision

- The arbitrator has up to 14 days from a hearing, or as soon as reasonably practicable if no hearing, to consider the evidence and come to a statutory and legally binding decision. The arbitrator’s award must be published (with any confidential information taken out).

-

Limited provisions of the Bill extend to Scotland and Northern Ireland, to ensure that certain insolvency proceedings could not be brought or measures applied in Scotland or Northern Ireland, in respect of protected debt in England and Wales. ↩